Risks of Lying on a Small Business Loan Application

February 25, 2019, 2:02 pm

Nearly all businesses face the need for some type of loans, whether for expansion, covering working capital, or paying for major business purchases.

The gold standard in lending is a business loan. That’s because it offers a lump sum upfront, amenable repayment terms over several months or years, and a fixed interest rate that keeps the cost of borrowing relatively low.

However, not all businesses can easily qualify for a loan. Thoughts of fudging the application numbers or financial records might seem innocent, especially if there is every intention of repaying the loan on time and in full. Sure, there’s a small chance a loan may be approved based on false statements or financial data. But business owners shouldn’t be tempted towards lying on a small business loan application, no matter how desperate the need for financing might seem.

Here’s what business owners need to know about the application process – and the risks of lying on a small business loan application.

Applying for a Small Business Loan

Small business loan applications follow a similar path as personal loan applications, with a few variations. First, business owners are required to provide detailed information not only about the business but personal financials as well. They most give legal and financial documentation as part of the application process. Lenders will review:

- Personal and business income tax returns

- Balance sheet and income statements

- Personal and business bank statements

- Business licenses and articles of incorporation, if applicable

- Financial projections for a newly formed business

- Revenue details from the most recent years

In addition to these documents, financial institutions may also ask for a detailed description laying out what the loan funds will be used to cover. Some lenders also want to review business plans, management team resumes, and product or service descriptions as part of an application.

Traditional business loan lenders will pore over the details provided so that a sound decision can be made on the creditworthiness of the borrower. Overall, the process can be cumbersome. But if approved, a small business loan is often the most affordable type of business lending.

Reasons People Lie on a Small Business Loan Application

Lying on a small business loan application may come to mind when business owners are not confident in their ability to qualify for a business loan. Shifting numbers upward, even by a small amount, can make for a stronger application – and therefore a higher probability of getting approved for affordable financing.

Some business owners may also feel the need to lie on a loan application because they are concerned about the future of the business. A loan might be their only hope of keeping the lights on and the doors open. Others might see a business loan as the only solution to expanding operations or rolling out a new product or service.

Whatever the reason for lying, it isn’t recommended.

Why You Can’t Get Away With Lying About Your Income

It’s difficult to lie on a small business loan application because of the detailed information needed as part of the application process. But that doesn’t mean applicants don’t do it.

Lying might consist of inflating the financial records of the business or the income of the business owner. Others might take it a step further by falsifying documents like tax returns or revenue statements to make the application appear stronger.

Some business owners might use stated income loans, also known as liars’ loans, to skirt around the requirement for providing business and personal financial documentation. However, even with stated income loan applications, lenders will take time to verify these details to ensure the business is a good fit for borrowing funds.

The most qualified business loan applicants have been in business for more than two years, have strong cash flow and annual revenue numbers, and have an owner that has a high credit score and spotless credit history. When this isn’t the case, lying on a loan application isn’t uncommon.

However, lenders will verify assets, income, and tax returns as best they can, leaving those who embellish the details facing negative consequences.

What Happens If You Get Caught Lying On Your Business Loan Application

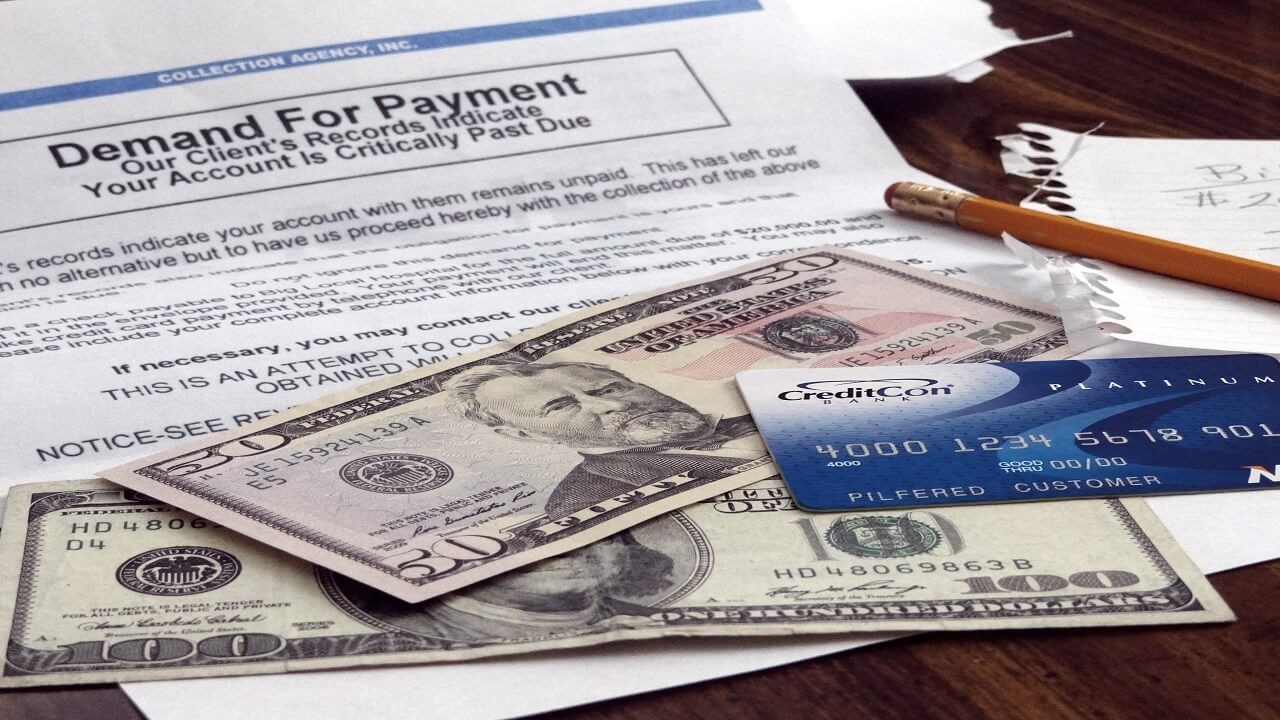

Lying on a business loan may lead to a slap on the wrist from the lender, in the form of being denied the loan funds. However, legal actions can be taken against a business owner who falsifies information on a business loan application. Providing false information to a financial institution is fraud, and while it doesn’t happen often, business owners can face financial penalties and jail time for lying.

One of the worst consequences of lying on a loan application, however, is taking on too much debt that becomes a burden to repay over time. Lenders look at the overall ability to repay as part of the application review process, and overstating assets and income could mean approval for a loan that carries a hefty repayment schedule.

Failing to repay a business loan, whether acquired truthfully or otherwise, could ultimately lead to the business closing its doors permanently. A business owner’s best bet is to allow the lender to approve – or deny – a business loan application based on accurate personal and business financial information.

P.S. Are you thinking of applying for a business loan? Use our Financial Calculators Dashboard to see if you can afford the loan

[Ed.Note. Jeff Gitlen writes about a wide range of finance topics including everything from student loans to credit cards to small business financing. Jeff's work has been featured on a number of sites including LendEDU, Bloomberg, CNBC, Forbes, Market Watch, and more.]

Share This Article: